Direct Material Price Variance is the difference between the actual cost of direct material and the standard cost of quantity purchased or consumed. Direct materials price variance account is a contra account that is debited to record the difference between the standard price and actual price of purchase. Sometimes companies have trouble figuring out the direct material price variance. Looking closely at these causes helps managers make better choices in the future. They can find ways to keep costs down and make sure they use resources well.

Implications of direct material price variance

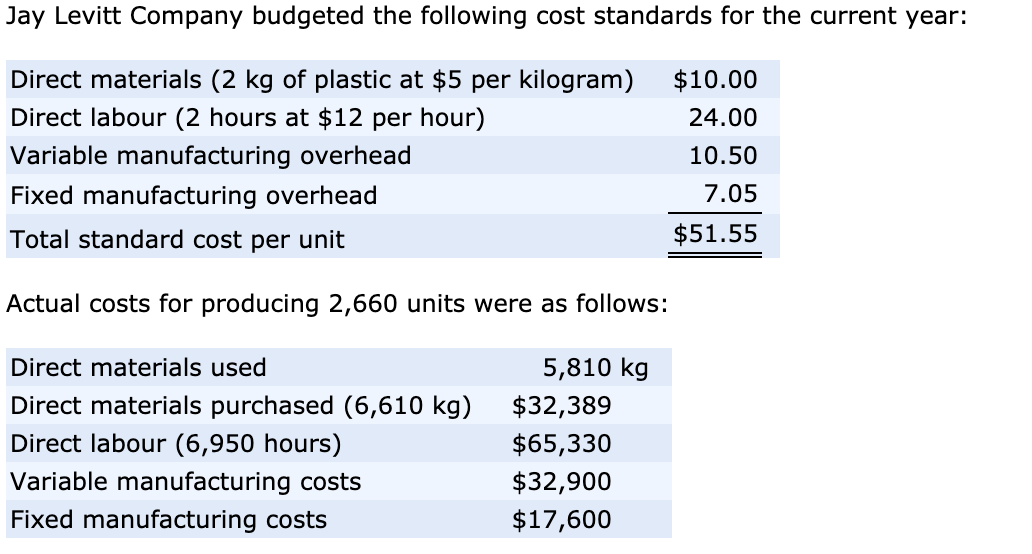

This is offset by a larger unfavorable direct materials price variance of $2,520. The net direct materials cost variance is still $1,320 (unfavorable), but this additional analysis shows how the quantity and price differences contributed to the overall variance. This variance helps businesses understand how efficiently they are managing their material costs and can highlight areas where cost control measures may be needed. The standard cost of actual quantity purchased is calculated by multiplying the standard price with the actual quantity.

How confident are you in your long term financial plan?

By delving into the specifics of variances, companies can uncover inefficiencies and make informed decisions to optimize their operations. The first step in this analysis is to regularly review variance what is the last in first out lifo method reports, which provide a snapshot of how actual costs compare to standard costs. These reports should be detailed and timely, allowing managers to quickly identify and address any discrepancies.

Direct Material Price Variance Calculator

Therefore, the purchase cost of the entire quantity must be compared with the standard cost of the actual quantity. The actual price must exceed the standard price because the material price variance is adverse. A solid grasp on them helps in maintaining tight cost control over materials procurement. It tracks if spending goes as planned or if there are surprises needing attention. After figuring out how much material you used, it’s time to look at the prices. You need to know both the budgeted price and what you actually paid for each unit of material.

The direct materials price variance of Hampton Appliance Company is unfavorable for the month of January. This is because the actual price paid to buy 5,000 units of direct material exceeds the standard price. The direct material price variance is the difference between the actual price paid to acquire a direct materials item and its budgeted price, multiplied by the actual number of units acquired. This information is needed to monitor the costs incurred to produce goods.

- It’s not just about knowing the number of units but understanding their role in cost variance calculation too.

- As another example, the decision to buy in different volumes may be caused by an incorrect sales estimate, which is the responsibility of the sales manager.

- For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

- This investigative approach ensures that corrective actions are targeted and effective.

Learn how to calculate, analyze, and apply direct material variance for effective cost control and improved financial performance. We’ll also include examples to display the process of calculating your direct material price variance. The manager may try to overstate it to protect himself from being punished if something goes wrong during the production (unexpected waste or error). Our selling price is higher than the competitors and for sure it will impact the sale quantity. An adverse material price variance indicates higher purchase costs incurred during the period compared with the standard. Now that we have understood the direct material price variance calculation, let’s look at how to interpret it.

Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own.

Whether it’s to pass that big test, qualify for that big promotion or even master that cooking technique; people who rely on dummies, rely on it to learn the critical skills and relevant information necessary for success. If items are needed quickly and ordered on a rush, the cost may be higher. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. Both formulas give the same answer so feel free to use whichever seems easier to you.