A mortgage re-finance will save you off an enormous payment per month and deposit some extra dollars in the membership across the enough time work with. Once you’ve decided you to refinancing is suitable to suit your condition, pick the causes for your refinancing and appearance to have the right financial that will do the job. To inside procedure, below are a few axioms you need to know concerning the functions out-of other financial education in addition to their packages.

The latest Government Housing Administration (FHA) has several refinancing package applicable for FHA funded property. An FHA improve re-finance choice will take relatively smaller documentation and less requirements than a traditional refinancing product. The fresh new qualification standards to possess a keen FHA streamline re-finance are:

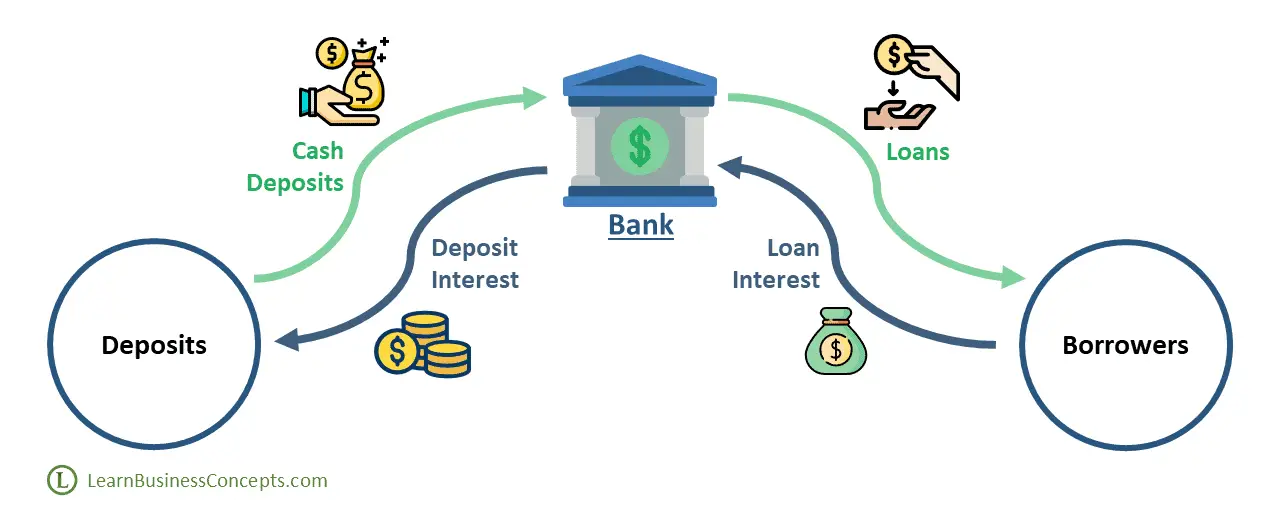

Axioms out of refinancing a mortgage

Choosing if this is a sensible for you personally to re-finance is determined by multiple issues. That valid reason to refinance should be to reduce the interest rate. But, you need to maybe not refinance its financial oriented solely on the lowest interest rate. There are many different other variables you to definitely see whether you to definitely will benefit regarding a beneficial refinancing system. A refinancing bundle will be reliant your own state and you may criteria. People whose financial predicament has actually improved can help to save off refinancing, by detatching the duration of the mortgage period and by reducing the principal commission, which will let them have the ability to save a tremendous amount of money. At the same time, if you are planning using a payday loan Madeira Beach difficulty, a lengthier financing term having a low interest will give your much more liberty. Apart from trying out the work-time, this new refinancing process relates to financing origination costs, assessment charge, payment fees, the fresh new lender’s term insurance rates, and so on. Determining a break-also section is among the just how do i pick whether the newest refinancing is worth your time and effort.

To be eligible for an effective refinance program, your own lender commonly envision several criteria including your monthly money, loan-to-really worth proportion in your home, your credit rating, additionally the security of your home. If you wish to make possibility of refinancing however, never afford to do so, because you owe more than the current worth of your home, a home Affordable Re-finance Program (HARP) are a suitable choice for you.

If for example the credit history provides increased because you grabbed out your brand spanking new financial, you happen to be in a position to refinance with additional favorable terms than everything you currently have. As a consequence of refinancing, additionally, you will have the ability to lose any Personal Financial Insurance rates (PMI) and you will save money. One of the almost every other explanations a lot of people consider refinancing would be to consolidate costs. Refinancing assists by throwing other mortgage loans and you may money significantly less than you to definitely mortgage which have best terms and conditions and independency. More prominent financing obtained from good refinancing can provide a source of extra cash that you can use for any objective. In cases like this, refinancing will save you regarding dangers of taking right out various other mortgage.

The 5 stages out of refinancing

Refinancing your residence mortgage could result in all the way down monthly premiums, a better interest, and/or prospect of which have a predetermined rate of interest also while the fixed costs. If you’ve been putting-off an effective refinancing decision since you was being unsure of of your process, have a look at after the book which is built to make it easier to can begin refinancing.

Are you thinking of refinancing to attenuate your monthly home loan payments? Could you be trying to lower your newest rate of interest? Like to improve your varying-rates home loan with a predetermined-speed financing? Deciding why you need to re-finance can make the process of in search of financing convenient and certainly will help you visited your ultimate goal.