Standards to own Assuming a good Va Loan

- You must have good several-few days reputation for on-date mortgage payments

- You must invest in assume all obligations associated with financing

- You must have sufficient residual income

- You must pay 0.5% of your loan equilibrium because funding fee (unless you has a being qualified provider related impairment)

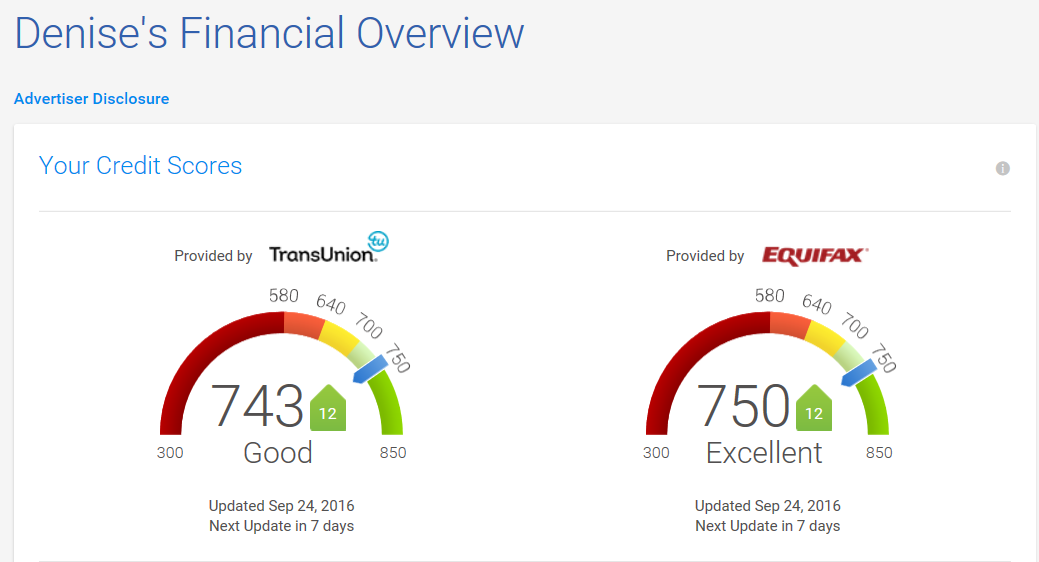

- You should match the lender’s borrowing and you may income criteria

If you are promoting a house having good Virtual assistant loan, you should definitely get a release of responsibility on brand new loan ahead of closing. A launch of accountability suppress you from incurring a serious borrowing from the bank hit-in the big event that the brand new client has actually any late costs or otherwise defaults with the believed mortgage.

- See if the property is approved having an excellent Virtual assistant financing assumption. Commonly, a vendor have a tendency to market in their house list when your possessions possess a keen assumable mortgage. Yet not, even though they won’t talk about it, it could be worth inquiring the vendor otherwise its home representative whether they have an effective Va loan to your property that they’d feel prepared to allow you to suppose. They may not have considered it yet would be unlock into the opportunity.

- Learn the seller’s current mortgage balance and interest. You need to determine if you really have adequate funds towards down-payment toward thought mortgage, therefore determining the level of the newest seller’s established home loan is crucial. Finding out the rate is additionally crucial, to determine whether the fresh new offers was significant enough to help you quality going through the Virtual assistant presumption techniques, or if it makes much more feel just to see a different sort of financing.

- Generate a deal for the house. You will need to tend to be conditions on the render you to definitely establish their home buy are contingent towards while current Virtual assistant financing.

- Complete any needed paperwork on lender. You’ll still need to be eligible for the borrowed funds expectation exactly as you would have to be eligible for a unique loan, so be sure to submit all the required documentation into lender. Might most likely require proof of earnings, information about other expenses and you can liens, and you will financial comments.

- Wait Patiently, and you will Imagine The Virtual assistant Home loan!

The ongoing future of Virtual assistant Financing Assumptions

Thousands of Virtual assistant qualified home buyers purchased functions when you look at the the final 10 years whenever interest levels had been often lower than step 3%. Regardless if Virtual assistant mortgage presumptions have not been especially prominent lately, as the prevalent rates was in the historic lows, they’re likely to getting very popular today inside the an environment out-of rising costs.

Also they are an excellent chance of homebuyers to save cash, and you can an aggressive opportinity for home providers to sell their house inside a buyer’s market. Va property owners was exclusively organized to offer their houses through this unique benefit, and now we prompt one contemplate it once the a choice!

However when assuming good Va mortgage, the fresh new Va funding percentage is just 0.5%. You can still find certain points the spot where the resource commission can be waived altogether, https://cashadvanceamerica.net/title-loans-pa/ such as for instance when the client is even a veteran possesses an assistance-connected handicap.

Although not, which definitely restrictions your pool from potential home purchasers which can be considered to visualize your own Virtual assistant financial, therefore consider carefully your arrangements meticulously and decide whenever you manage to have your qualifications tied up. Regardless if giving your own Va loan to have assumption to help you a non seasoned buyer are a significant selling point, it may not getting worth it whether it limitations your ability to purchase your 2nd put. Speak to your lender regarding the if you will have sufficient Virtual assistant qualification remaining to purchase your second household, or if you can use a traditional otherwise FHA mortgage getting you buy rather.