That have a changeable-speed mortgage (ARM), the pace transform from time to time. He is generally characterized by the time that has to admission before rate would be altered (step 1, 3, 5, 7 or a decade, including). Costs are http://paydayloansconnecticut.com/willimantic/ generally less than repaired-speed mortgages, but carry the danger you to definitely an increase in interest levels have a tendency to produce large monthly obligations.

FHA-Insured Money

The latest Government Construction Administration (FHA) now offers numerous reasonable-down-commission financial things getting eligible users. Having advice and you can qualification criteria, contact your lender otherwise head to:hud.gov/fha.

VA-Secured Loans

When you are a veteran out of armed forces provider, reservist, or to the productive armed forces obligations, you may qualify for financing verify on Department out of Pros Issues. These types of financing enjoys low down money.

All about home inspections

Loan providers may require you have your own prospective domestic examined by a professional prior to it accept your own home loan. No matter if they won’t, hiring an inspector is an excellent means to fix manage your investment. They may figure out structural, electrical otherwise plumbing work problems that you can expect to impact the sales price. But an extensive evaluation are going to be useful in alternative methods. The very last report are going to be a plan getting some thing the buyer would be thinking about five or maybe more years in the future, like starting an alternate roof, heating system or hot water tank. Home inspections, and that generally speaking prices between $300 and you may $600, is also let you know architectural issues that could possibly get change the selling price and your interest in the house. House inspectors is actually authorized from the county.

Not as much as Wisconsin laws, building inspectors was responsible for damage you to arise out of a work otherwise omission in accordance with the inspection. While doing so, he is banned regarding starting any repairs, repairs or developments into examined assets for at least several age adopting the review possess happened.

To find out more from the statutes or even to read the reputation from an enthusiastic inspector’s license, delight call (608) 266-2112 or browse “home inspections on: dsps.wi.gov.

First-Date Homebuyers

Buying your earliest household might be difficult offered all the details as well as the money required for a downpayment. Luckily, the state of Wisconsin also provides informative and financial help from Wisconsin Housing and you can Economic Development Company. To find out more, visit: wheda/homeownership-and-renters/home-buyers

Prominent Financial Terms

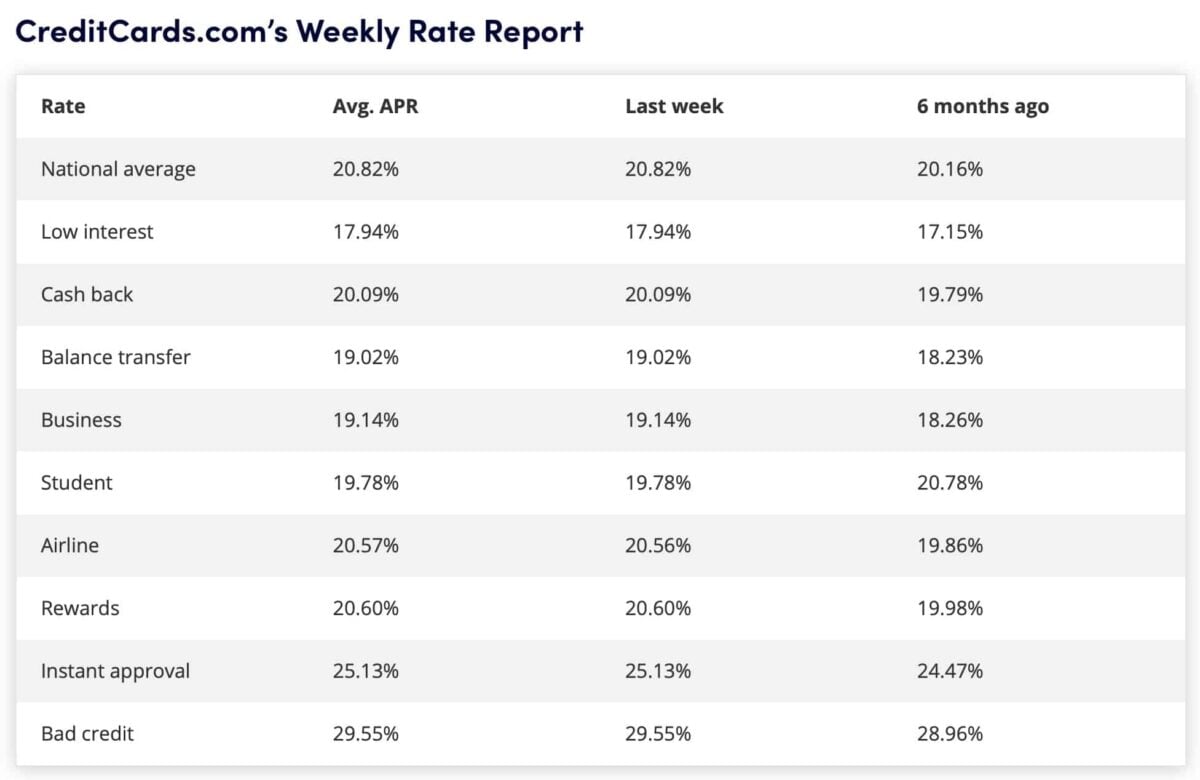

- Annual percentage rate (Apr): Whilst has affairs, expenses or any other can cost you billed of the lender, here is the genuine interest rate you’re investing. Due to the fact the lenders need compute this profile exactly the same way, the newest Apr will bring a beneficial way for evaluating financial proposals.

- Appraisal: A quotation of your own property’s market price according to research by the updates of one’s framework, the value of the fresh homes and the properties of one’s neighborhood. Appraisals are usually expected and in case a home is purchased, ended up selling otherwise refinanced.

- Assumable Mortgage: Home financing which is often absorbed of the client having a fee. This type of mortgages avoid closing costs and you may mortgage charge.

- Closing costs: Costs produced to the closing day to pay for attorney charges, appraisals, credit history, escrow fees, prepaid insurance fees or any other charges

- Prominent Area Tests: Called homeowner relationship costs, talking about fees paid down of the tool people to keep the house.

- Down-payment: The amount of bucks paid back because of the citizen at that time from closure. One deposit that is below 20% of your own cost constantly requires mortgage insurance policies, hence boosts the buyer’s monthly premiums.

- Escalator Condition: A supply which allows the lending company to change the interest pricing and/or amount of the loan if field requirements transform.

- Fixed-Rate Mortgage: Financing which have a predetermined interest one to stays ongoing more than the life span of one’s loan.