A report form refers to a balance sheet that presents a fiscal year in one column. It starts with assets and provides a total value of assets at the end of the section, followed by liabilities, equities, with the final section totalling up the combined value of liabilities and equity. The balance sheet is meant to give you a clear view of what your business owes and owns. The insights you can gain from the balance sheet—along with other financial statements—allow you to make informed financial decisions as your business grows. A balance sheet, along with an income statement and cash flow statement, is an integral part of your financial reporting. Countries may follow different accounting principles and regulations, impacting the structure and interpretation of a classified balance sheet.

Non-Current Liabilities – The Classified Balance Sheet

The classified balance sheet format and the regular balance sheet are two methods of presenting financial data to management, shareholders, analysis and other investors. A well-represented and well-classified information instills confidence and trust in the creditors and investors. It conveys a strong message classified balance sheet template to the investors that their money is safe as management is serious about the business’s profitability and running it ethically and within the rules of the land. It also tells a lot about management, who wants to be open about their assets and valuations and how these valuations have been calculated.

How can Taxfyle help?

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Continuing with Bob and his donut shop example, we can see how his traditional balance sheet and his classified balance sheet would look at the end of his financial period, i.e. month-end. Balance sheet liabilities, like assets, have been arranged into Current Liabilities and Long-Term Liabilities. When your balances have been added to the right categories, you’ll add the subtotals to show up at your total liabilities, which are $59300.

- If it’s paying out a lot of dividends, it means the owners are getting a good return on their investment.

- The creditors and investors have all the required information to decide about investment or issuing loans.

- Long-term investments are the assets of the company that cannot be liquidated within 12 months.

- The first group is called “current assets,” which are things the business plans to use or turn into cash within one year, like the money in the cash register or the supplies in the store.

- A classified balance sheet is like a big box that holds information about what a company owns and owes, all sorted into neat groups.

Discover more from CFO Consultants, LLC Trusted Financial Consultants

In summary, classifying items on a balance sheet into assets, liabilities, and equity helps everyone understand the financial health of a business. It shows us what the company owns, what it owes, and the value left for the owners. This makes it easier for people to see how well the company is doing and to make smart decisions about investing in or lending money to the business. An investor who is keen on the everyday tasks and profitability of the firm might want to compute the current ratio.

Free up time in your firm all year by contracting monthly bookkeeping tasks to our platform. We strive to empower readers with the most factual and reliable climate finance information possible to help them make informed decisions. Go a level deeper with us and investigate the potential impacts of climate change on investments like your retirement account. Doing so allows you to see how your financial circumstances have changed and identify areas for opportunity and improvement. Company B has a lower Debt to Asset Ratio, indicating less leverage and potentially less financial risk in the long term. With Taxfyle, your firm can access licensed CPAs and EAs who can prepare and review tax returns for your clients.

Prepaid Rent: Asset or Liability?

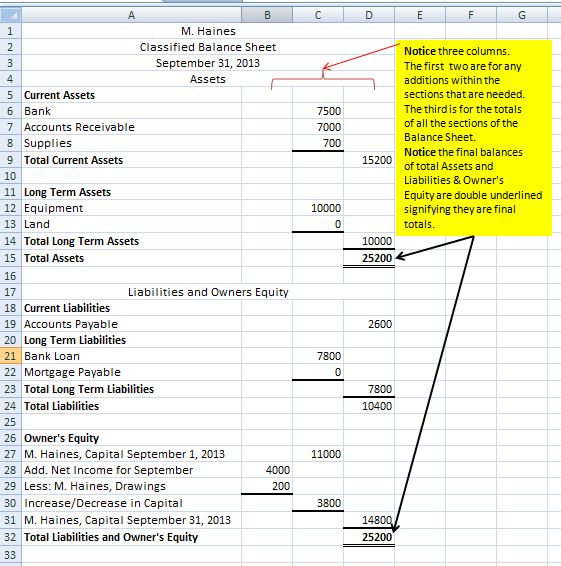

Here is a classified balance sheet format and most of the items such a balance sheet contains. It corresponds to the amount paid to the shareholders if a company is liquidated and all assets are sold out. The format of the classified balance sheet ‘s liabilities side can be divided into three main categories. The format of the classified balance sheet ‘s asset side can be divided into three main categories. Advisory services provided by Carbon Collective Investment LLC (“Carbon Collective”), an SEC-registered investment adviser. Throughout this series of financial statements, you can download the Excel template below for free to see how Bob’s Donut Shoppe uses financial statements to evaluate the performance of his business.

Examples of current liabilities include accounts payable, accrued liabilities, current portion of long term debt (CPLTD), deferred revenue, etc. In simple terms, classified balance sheets give a clearer view of a company’s financial health by organizing its financial information neatly. This organization helps everyone, from the company’s managers to investors and creditors, quickly understand the company’s financial status, making it easier to make decisions for the future or about investing. Unclassified balance sheets, while simpler, don’t provide this level of detail, making it tougher to get a quick understanding of the company’s finances. The uniqueness of classified balance sheets lies in their detailed categorization of a company’s assets and liabilities, which provides a richer, more insightful analysis of its financial health. Here, we will explore the basic structure of a balance sheet, how classified balance sheets add a layer of sophistication, and why these classifications are so crucial.

We handle the hard part of finding the right tax professional by matching you with a Pro who has the right experience to meet your unique needs and will manage your bookkeeping and file taxes for you. Finding an accountant to manage your bookkeeping and file taxes is a big decision. Set your business up for success with our free small business tax calculator. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including MarketWatch, Bloomberg, Axios, TechCrunch, Forbes, NerdWallet, GreenBiz, Reuters, and many others.

In Classified Balance Sheet Format, there are three basic elements of like Assets, Liabilities and shareholder equity. Information regarding their details can either be provided by wider categories or it can be presented by subcategories to show classification of its basic elements. A classified balance sheet provides a structured and clear view of a company’s financial position, allowing for better decision-making and strategic planning.