- Financial underwriters examine your software and you may data to accept otherwise refuse the job

- Hosts is also accept mortgage loans, however, person underwriters need certainly to verify that your write-ups fulfill the suggestions in your app

- Underwriters usually wanted evidence of your revenue and assets and can even enjoys extra requests

Your recognition can often be susceptible to criteria. These requirements can range regarding bank statements to help you tax statements to explanations about your credit. Most of the conditions should be in the and recognized before you could intimate.

They begins with a credit card applicatoin

You start the application form procedure because of the dealing with that loan officer otherwise loan processor chip. He or she takes your information and you will completes an interest rate software.

Your loan administrator ratings the loan Imagine (LE) setting or other disclosures to you, solutions your questions concerning the variations, and you may tells you all you have to make available to safe your own mortgage recognition.

Underwriters glance at an excellent borrower’s three Cs. That is reputation, collateral and you may strength. Simply put, your credit rating, money as well as the worth of.

Underwriters commonly always people

Quite often, your loan officer or chip submits the application digitally in order to an automated underwriting system (AUS). The application form creates a suggestion and a listing of standards, that you need certainly to fulfill so the original source you can submit their recognition. (Fannie Mae’s Pc Underwriting body’s overall performance include agree, recommend, otherwise send that have alerting.)

If you get an effective refer effect, a person underwriter has to take an extra browse and maybe underwrite the loan manually. Recommend having caution translates to the computer refuted the job.

If you get a keen approve response, the device kicks aside a list of criteria you ought to see so you can execute your own recognition. The loan officer will help you rating these things, and you can a human underwriter will make sure the documents your bring satisfy the information regarding the loan app.

Financial underwriter checklist

A first character of your underwriter should be to agree money you to is going to do and you may restrict chance. It means very carefully investigating a beneficial borrower’s entire financing profile. Normal opportunities are

Examining credit rating. Your credit history the most techniques into the the mortgage approval processes. Underwriters get to know your credit history because of the way you addressed obligations prior to now is a good predictor from the manner in which you have a tendency to handle the financial obligations. Later payments otherwise stuff will need even more documents.

Verifying a position and you may earnings. Underwriters guarantee your a career records to be certain your income was steady. They might name your boss to ensure that you functions around and will review the past two years’ W-2s otherwise tax returns. Underwriting expertise and evaluate your earnings and you can expense, figuring what’s titled a personal debt-to-earnings proportion, or DTI.

Consider house appraisal. A licensed household appraiser compares the home so you’re able to regional, similar belongings, and you will sets its ine the brand new appraisal to be sure this new appraiser observed new lender’s assistance and made right adjustments to access the benefits given to your property.

Be certain that asset guidance. Your down-payment is actually a factor and you may underwriters study it very carefully. Achieved it come from your finance? Otherwise does your history family savings statement contain specific weirdly huge put? They will test you and inquire about significantly more files, in that case, so as that this new down payment wasn’t borrowed or given by somebody who benefits from this new marketing, such as the seller otherwise real estate agent.

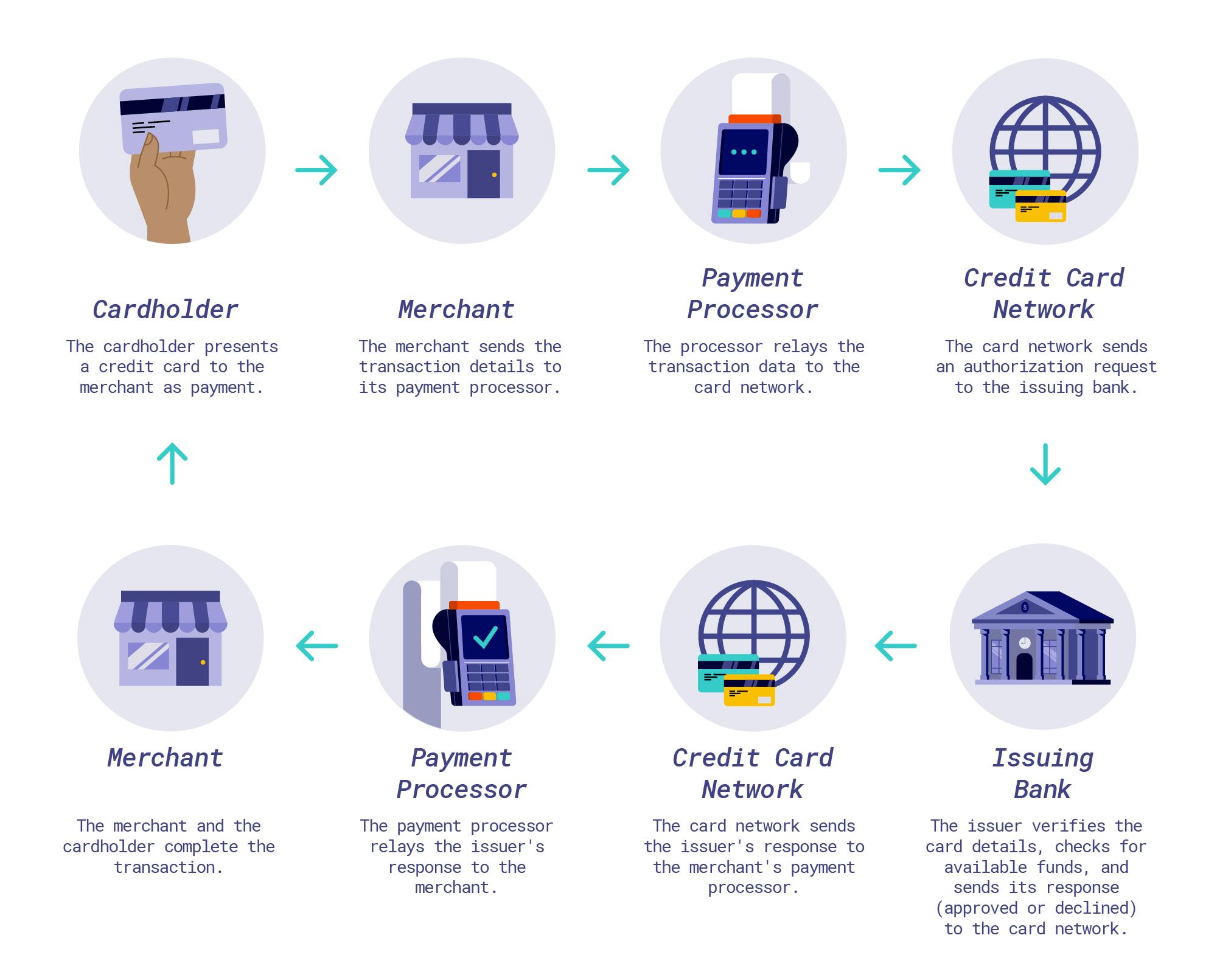

Automatic underwriting

Very banking institutions and you will mortgage lenders use Automatic Underwriting Possibilities (AUS). He or she is excellent application solutions that offer original underwriting conclusion.

The device lets the human underwriter determine if home financing candidate matches the fresh lender’s guidelines, centered on advice regarding loan application and you will credit history.

Immediately after a loan officer otherwise chip submits a software, the fresh new AUS account its results and you can makes conditions. Constantly, criteria simply cover demonstrating that what was input to your software holds true – bank statements and spend stubs, by way of example, to ensure money and you can assets said to your software.

Most lenders do a little manual underwriting out of home loan software. Usually, this is because the fresh new candidate possess an insufficient credit history and/or credit report might have been compromised from the identity theft & fraud. Strange mortgage loans or very big money also are seem to underwritten manually.

Approved that have criteria

There are certain steps in bringing a mortgage loan. Pick was home loan pre-qualification. And you’ll done a credit card applicatoin and fill in it to possess home loan pre-acceptance. Shortly after your loan comes out off underwriting, the target is to get loan recognized that have standards.

Avoid being fearful if the financial informs you your recognition features conditions. Good conditional financing acceptance is quite fundamental. Rewarding the loan criteria, whatever they is, is when you change the conditional mortgage recognition with the a full/last recognition.

Underwriting standards can differ with regards to the sorts of loan to have which you have used, the a career, money and full borrowing from the bank reputation. The method that you otherwise their lender finish the home loan software can dictate your approval therefore the standards you must satisfy.

Last approval

Types of underwriting requirements can include sets from paperwork out-of right homeowners insurance so you’re able to characters regarding reasons for sure belongings in matter along with your mortgage file.

And several requirements can be produce a request for a lot more of those. As an instance, your pay stub consists of good deduction having child help you did not wear your application. Today you will have to offer the divorce or separation decree.

The great thing can be done just like the a soon-to-getting resident is always to function timely for the financing officer’s requests. It is in addition crucial to see not to ever shoot brand new messenger right here.

The loan manager is your liaison anywhere between you and the latest underwriter. Or even learn or are unable to comply with a disorder, he/she could possibly support you in finding good ways as much as it and have the loan closed. Remember that the financial institution workers are sooner in your favor and performing their very best so you’re able to personal the loan timely.