Credit up against your own property’s security tend to comes to a home loan most useful-up, enabling a rise in your existing loan restrict. Thus giving cash having protecting a residential property, eliminating the need for an alternate bucks deposit. The fresh feasibility out-of a mortgage finest-right up depends on circumstances like financing form of and you can cost potential, and it’s advisable to payday loan Stewartville consult with your financial about this solution.

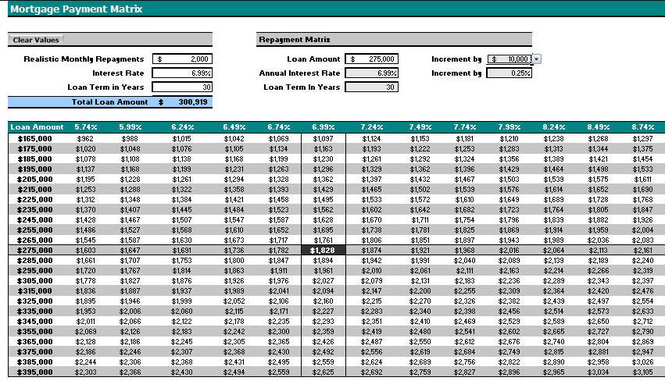

Going for home financing top-upwards needs careful consideration, because relates to even more payments across the original financing title. Accessing collateral boosts the balance towards the financial, resulting in higher costs. Its important to fool around with a repayment calculator so you can estimate the new feeling in your payments and measure the economic effects just before continuing.

Secondary loan account

If you want to not increase your present mortgage equilibrium, a choice is to utilize their equity of the establishing another second financing account. This package allows you to see keeps different from your financial, such as an alternate repayment volume otherwise a different type of interest, such a fixed speed.

When going for a special mortgage to get into collateral, you can like financing that have another type of identity. Yet not, be mindful since this this new loan have a lengthier identity than simply your one to, possibly extending the fresh cycle more which you spend interest toward whole amount borrowed.

Cross-collateralisation

Cross-collateralisation is a method used by certain investors in order to leverage available security for selecting a residential property. It involves by using the established assets just like the security and you can adding it towards the fresh new investment property loan. That it leads to a couple of funds: the initial mortgage covered from the current possessions additionally the new home loan protected from the both the current and funding properties.

But not, cross-collateralisation comes with prospective disadvantages. It may give smaller independence compared to the almost every other collateral incorporate measures. Having both bonds tied to you to definitely financing can make difficulties if you really need to separate them afterwards, including when offering you to property. This step will get involve rewriting the mortgage for the assets you might be staying, ultimately causing yet another membership matter, mortgage deal, and lender valuation.

Household Guarantee Loan Risks

Household equity fund permit borrowing facing your own residence’s equity having a lump-sum payment paid through the years in the a fixed interest and monthly payments. Several primary risks accompany this type of finance:

- Defaulting towards the payments may lead to shedding your home.

- Declining household worth can lead to getting under water on money, restricting what you can do to go otherwise offer without paying the lenders.

Owning a home Dangers

The latest construction market’s upcoming are undecided, with a slowdown present in 2023 due to rising interest rates. Investing in a home during the a market lag could possibly get perspective demands, given settlement costs, large notice money, and you can possible repair expenditures.

A house investing, immediately after accessible, today demands skill and official knowledge for market research, rental research, and you will figuring return on investment. Luck during the a trending business does not make sure genuine triumph, and developing assistance takes some time.

Taking advantage of family flipping in the current sector can be challenging. For rental property financial investments, thorough lookup into rental business and you can regional regulations is vital, particularly considering pandemic-relevant eviction moratoriums.

Prior to using a property collateral loan to have resource, assess debt ability to deal with mortgage payments and prospective rental earnings openings. If the unable to experience costs for over annually instead of leasing money, the possibility of shedding your property can be obtained. Have a look at so it exposure contrary to the potential inactive money award in advance of opting having a house security financing.

Methods for investing in assets

- Check out the local field, knowledge leasing demand and assets price style.