Content

You are accountable for all will cost you of utilizing this service membership and you may doing work the new Get Tool, and, however limited by mobile and internet service fees. You’re accountable for keeping the brand new body’s ability and you can associations needed to be used of the Provider. There’s no more payment for using Mobile View Deposit but we recommend that your consult with your provider observe when the there are one cordless provider charges.

- Users who qualify while the a part of Well-known Financial programs have a great $10,100000 each day and you may $25,000 monthly limitation.

- After you’lso are in a position, faucet up on complete the cellular deposit procedure.

- Individuals have to plan all the appointments at the very least 48 hours just before start day.

- In order to put the fresh look at as a result of a financial application, take an image out of both parties.

- Picture quality.You’re accountable for the picture top-notch people Photo you to definitely your shown.

- If your cellular look at deposit isn’t functioning and also you believe you’ve over everything you accurately, there is a problem with your own cellular banking software.

Which means you was motivated to choose some other payment approach when your request a detachment. BT ‘s the only United kingdom operator so that repayments by landline, providing to help you customers whom is generally from a mature generation and you may less inclined to own a cellular telephone. It’s and a good selection for players who lose their cell phones however, wear’t need to overlook seeking the fortune on the web. It’s good to learn which the main organization is actually because of it provider in order to be sure you’re also playing with a trusted service after they show up on your mobile cell phone expenses.

Fast toward the present day time and you can … you will still must take your report consider for the nearby financial department otherwise Automatic teller machine. Nowadays you could put a from the comfort of your family room in just a few times, because of the mobile put element on your lender’s mobile app. As stated a lot more than, simply because you deposit a check through your lender’s cellular app doesn’t imply you might throw out of the view.

There is no costs to make use of Cellular Deposit1

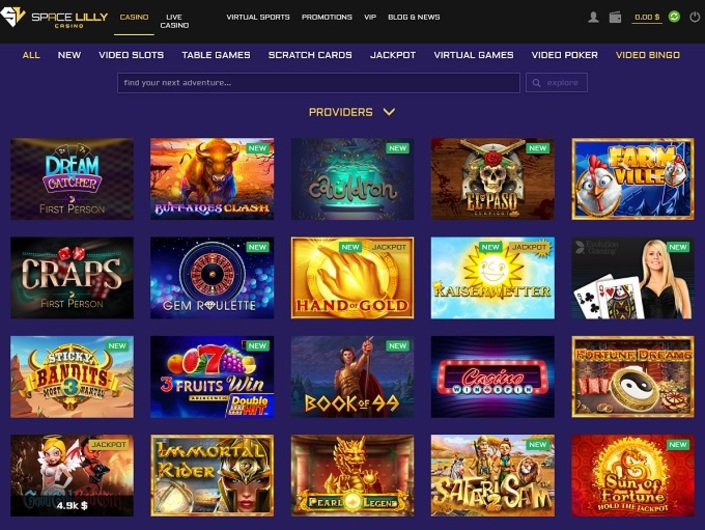

To take action, the ball player simply does need to take the brand new local casino site and you may visit the new banking area having fun with a telephone. This site usually inquire the gamer to input their otherwise their cellular amount along with the wished level of deposit. Then a confirmation message might possibly be provided for guarantee the security of the contact number.

Why does cellular deposit functions?

If you do intend on to try out thru cellular phone, you’lso are in for a delicacy because most cellular models of the favourite casino however provide incentives that come with signing up otherwise because the a publicity. After that you can start using the 100 percent free plays to try out the new mobile gambling enterprise. Even though, browse the fine print for the betting criteria first before attempting to help you claim your own earnings from these no deposit incentives while the local casino constantly demands a particular share to help you wager prior to earnings. But not, it’s better not to explore personal Wi-Fi for sensitive and painful suggestions otherwise some thing demanding their lender code. It’s a good idea to make use of a safe wired or wifi—or their mobile’s analysis union—if you wish to end revealing delicate information. Cellular look at dumps are generally safer, and so they could even stop specific types of scam.

Cellular Deposit Limitations Can still Changes and you may Disagree Because of the Account

Such limitations will be in line with the type of account, your put background, just how long https://mrbetlogin.com/fantastic-7s/ the brand new membership could have been discover and other issues having their financial matchmaking. After you’ve submitted your mobile put, the brand new software have a tendency to broadcast every piece of information on the bank and also you is always to come across a confirmation message. According to once you deposit the newest consider, it could take a business couple of days to the financing to become obtainable in your bank account. Cellular take a look at put spends remote put take technology in order to put the fresh consider fund into the family savings. It tool lets banks undertake dumps playing with electronic photographs of one’s back and front away from a unlike demanding the first papers consider becoming individually placed in the a part or Atm.

Mobile consider put will be a handy solution to deal with places to help you a checking, discounts or currency field membership. There are lots of banks and you can borrowing unions offering cellular view put because the an option. If your financial institution doesn’t provide it, you can also think starting a merchant account someplace else. Other than cellular deposit take a look at provides, here’s things to consider when changing financial institutions. However, view places may take a few days to clear with a lot of banking institutions, but a handful give cellular view dumps having instant finance availability.

After you’re sure everything try direct, submit the brand new consider for the financial and wait for the verification of your own deposit. To be sure there are not any problems together with your mobile deposit, capture images of one’s check in a highly-illuminated city as well as on a condo skin one’s obvious and you may ebony. Ensure the fresh look at try fully inside physique one to you see and that very little else is visible. You’ll become directed so you can snap a picture of the front and straight back of your own consider. Make sure you maintain your register a safe place if you don’t see the full put matter listed in your account’s past/previous deals. When you perform, be sure to destroy the fresh look at instantly by shredding they or having fun with various other secure method.

Deposits built to your money in the retailers through the Eco-friendly Dot Community get incur a fee as much as $4.95 for each and every purchase. It’s also essential to find out perhaps the lender imposes one limits to your amount of cash — or the amount of money debts — it requires per Automatic teller machine purchase. The essential difference between “Depositor” and “Recorded by” merely relates to put membership that have a trusted Representative listed. For those transactions, the primary membership holder’s name is displayed while the “Depositor” and also the Respected Member is displayed as the “Submitted because of the.” Check to see if any Android permissions is curbing mobile deposit.

We would discovered payment from your affiliates to own appeared placement of items. We may as well as receive fee for many who click on specific backlinks posted to the all of our webpages. Some financial institutions, for example PNC otherwise Us Lender, will get ensure it is a to clear inside same day when the transferred just before ten p.meters. If you attempt to put the newest take a look at after this time, you’ll likely have to wait through to the next day for it to pay off.

The brand new Navy Federal Credit Partnership confidentiality and you can protection rules don’t connect with the brand new linked website. Certain checks may take extended to techniques, therefore we may need to hold particular or all the deposit to own a small prolonged. We will reveal if we must keep in initial deposit and can include information regarding when you should assume your bank account. We’ll let you know whenever we have to keep a deposit and can include details about when you should assume your finances.